Global Execution Management Platform for Equities Business.

A US-based equities business successfully used an internally developed execution management platform for program trading over several years.

The platform fully met business needs from a performance perspective (supporting ~10,000 orders per day), offered robust functionality (including all required trading and auto-execution features), and complied with SEC, FINRA, and other regulatory requirements.

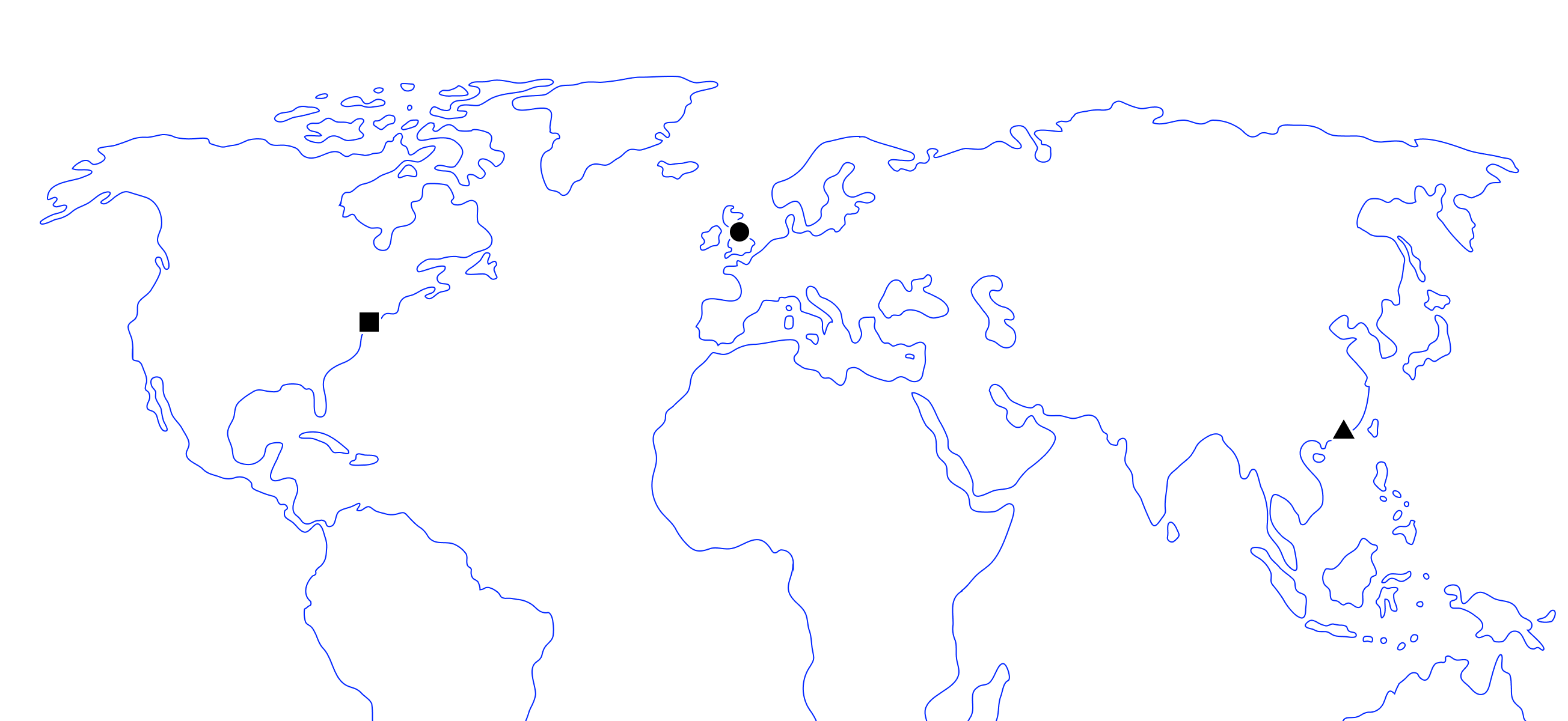

When the business expanded into the EU and APAC regions, the engineering team faced several challenges:

- Slightly different business functionality and controls across regions (e.g., best execution, short selling, price markups/downs)

- Additional regulatory reporting requirements (FCA, ESMA, SFC, MAS, etc.)

- New execution venues

- 24/5 operating hours

- A 5x increase in system load

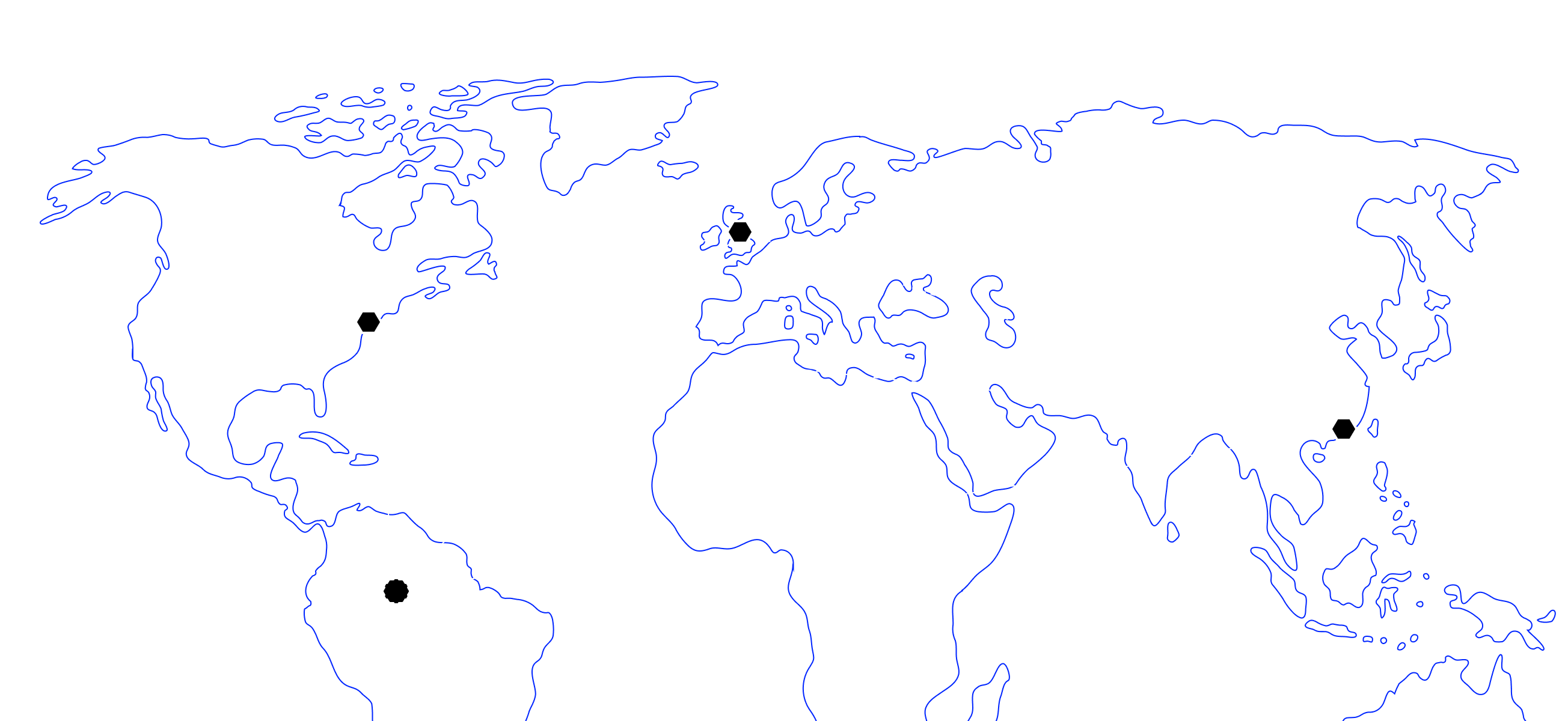

Rather than creating separate platform copies for each region and maintaining them independently, the findev engineering team preserved a single global platform.

This approach ensured:

- Simultaneous delivery of core functional improvements and security patches across all regions

- Flexibility to introduce region-specific features based on local business, reg&compliance needs

The enhanced platform supported up to 100,000 orders/day globally while maintaining compliance and performance standards operating 24/5 (follow-the-sun business model).